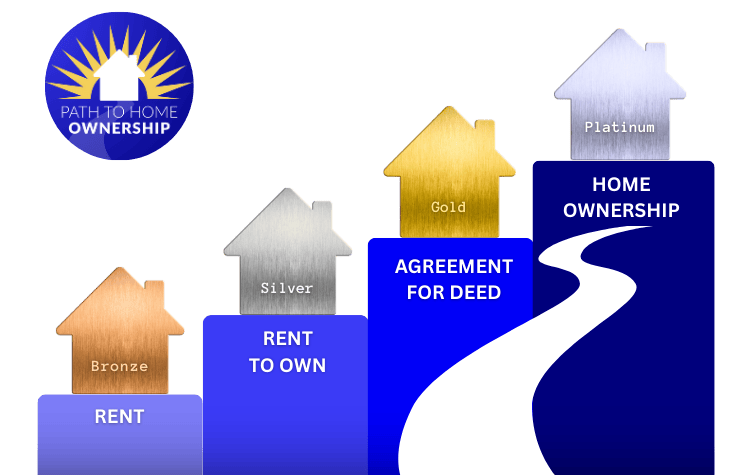

Freedom Through Flexible Financing

Even if the banks have said no, you can still own a home. Our flexible financing options are designed to meet you where you are and move you toward ownership.

Financing That Works For You

Flexible terms & options designed to open doors to homeownership

At Buy Without Banks, we believe your past should not determine your future. Because we are not a bank, our financing is built around flexibility. Interest rates and terms are designed to fit your situation, and every option is focused on making ownership possible and sustainable for you.

Flexible Interest Rates

Rates typically range from 7.5% to 10.5% and are influenced by your down payment and financial profile.

All Credit Considered

Past financial challenges do not stop you here. We look at your ability to make consistent monthly payments.

Paths That Fit Your Life

Our program includes rent-to-own and owner financing, giving you time to strengthen your finances while living in the home you want.

Support For Long-Term Success

When you are ready, we connect you with licensed mortgage brokers who can help you secure permanent financing.

Let’s Get Started!

Submit Your

Home Match Request

Take the first step toward owning your own home without the banks. Our quick and simple application helps us understand your situation so we can match you with the best path forward. Don’t let credit scores or past financial challenges hold you back. Apply today and start building your future with confidence.

Our goal is not just to buy and sell properties but to create lasting stability for families. Flipping houses or renting may generate quick profits, but it does little to solve the real problem many people face: the inability to qualify for a traditional mortgage. By focusing on helping families become homeowners, we give people the chance to build equity, create security, and enjoy the pride of owning a home of their own.

Yes. We meet you where you are financially and help you start at the level that makes sense for your situation. From there, you can move forward at your own pace.

Your payments depend on the program level you are in. Rent payments give you stability now, while rent-to-own and owner financing options allow part of your payment to build equity toward ownership.

We do not rely on strict bank rules or credit score requirements. Instead, we offer a flexible path that allows you to move into a home now and progress toward ownership step by step.

No. Many of our buyers have credit challenges, are self-employed, or have past financial setbacks. We focus on your ability to make consistent payments and your commitment to becoming a homeowner.

In most cases, you can move in right away. This gives you stability and comfort while you work through our program and move closer to full ownership.

Our homes come from properties we buy and make available through our program. Some are move-in ready, while others may need repairs or updates that allow you to build equity and customize the home to your taste.

That is not a problem. Many families begin with little or no down payment. Our program is designed to help you save and strengthen your financial position as you progress toward ownership.

Thousands of families across the country have successfully used the Path to Home Ownership to buy homes without banks. You will also have the chance to hear real stories and meet people who have completed the program.

That is perfectly fine. You can start with renting, gain stability, and move into the next level when you are ready. The program is designed to meet you where you are and move forward at your pace.

Yes. All agreements are structured with transparency and fairness, ensuring your rights are protected and your path to ownership is clear.

In many cases, buyers are responsible for repairs and improvements. This allows you to add your personal touch and build equity as you invest in the property.